Dailyfreeprintable.org – Welcome! You’ve stumbled upon the place where free printables abound. Need some resources for your next project? Or maybe some fun decorations? Well, you’re in luck! We’ve got them all right here, and they won’t cost you a dime.

Understanding the Importance of a Free Printable Checkbook Register

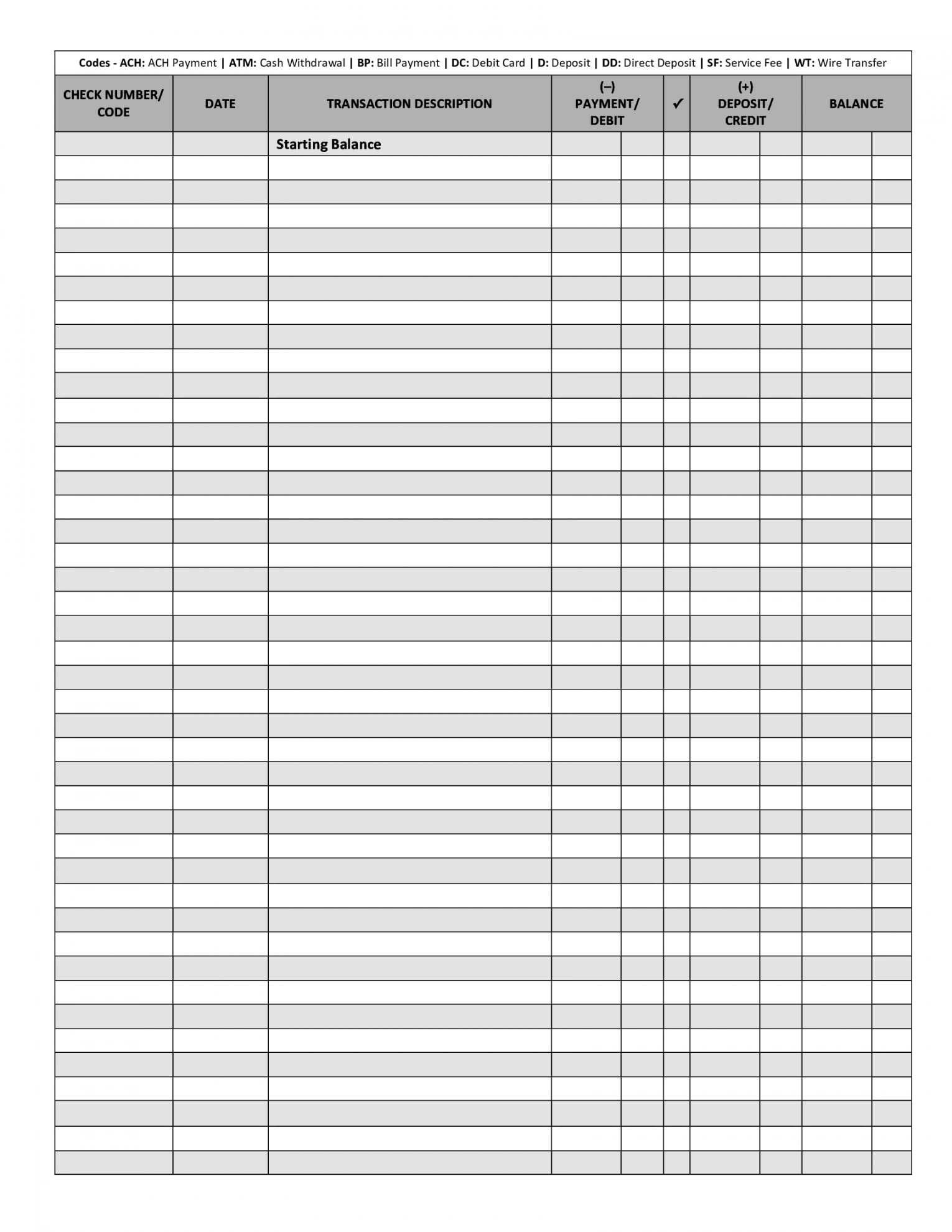

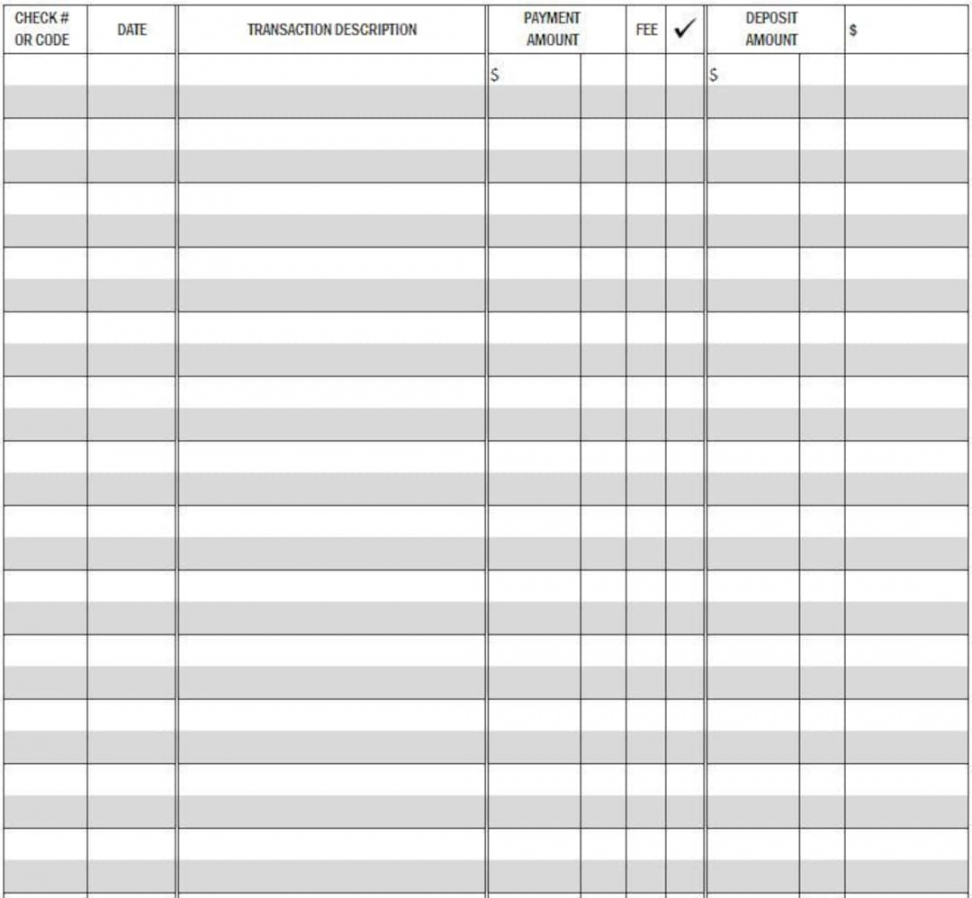

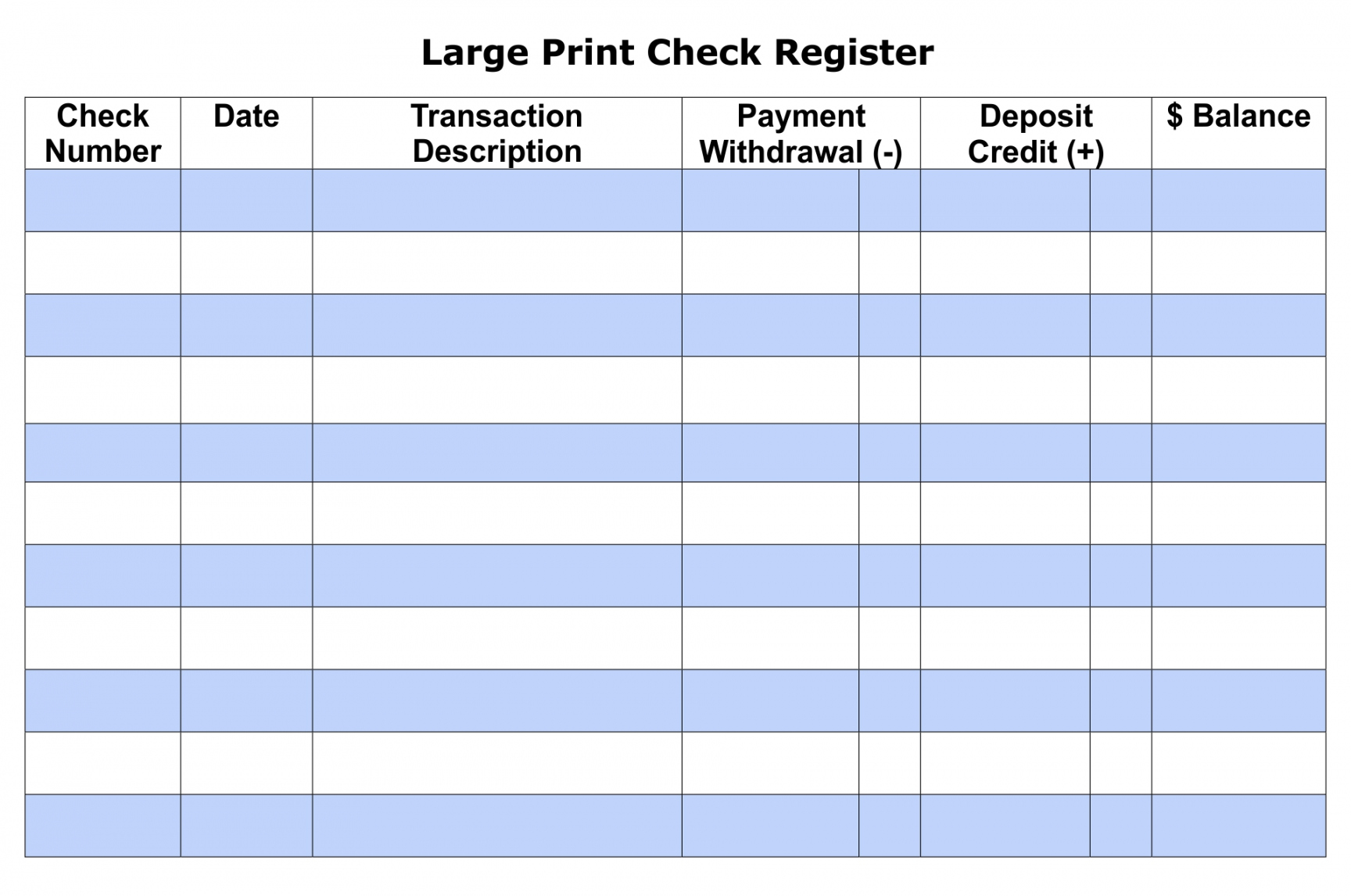

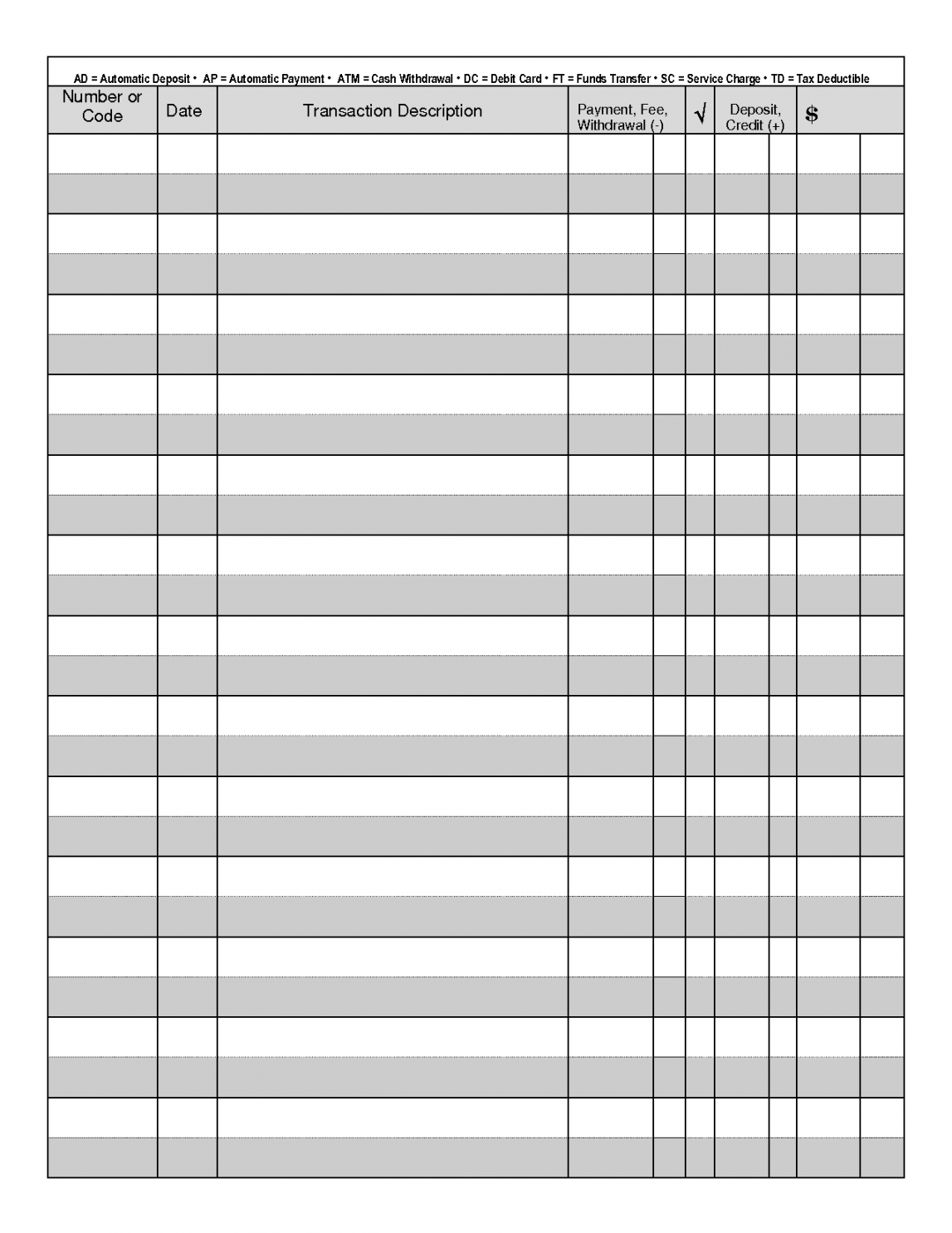

Keeping track of your finances is essential for maintaining a healthy financial life. One tool that can help you stay organized and manage your expenses effectively is a checkbook register. A checkbook register is a simple document that allows you to record all your transactions, including checks written, deposits made, and any other activity related to your bank account. While many banks provide checkbook registers, some people prefer the convenience of a free printable checkbook register that they can easily customize to fit their needs.

Benefits of Using a Free Printable Checkbook Register

Using a free printable checkbook register offers several advantages over relying solely on your bank’s provided register:

1. Customization

With a free printable checkbook register, you have the freedom to customize it according to your preferences. You can choose the layout, font size, and even add additional columns or categories to track specific expenses that are important to you.

2. Accessibility

A printable checkbook register is accessible whenever you need it. Whether you are at home, on the go, or don’t have access to the internet, having a physical copy of your register allows you to record transactions immediately, ensuring accuracy and preventing any missed entries.

3. Visual Tracking

A checkbook register provides a visual representation of your finances. By recording your transactions manually, you can see at a glance how much money you have available, how much you have spent, and what bills are due. This visual tracking helps you make informed financial decisions and avoid overdrawing your account.

4. Budgeting Tool

A printable checkbook register can also serve as a budgeting tool. By categorizing your expenses and comparing them to your budget, you can identify areas where you may be overspending and make adjustments accordingly. This will ultimately help you manage your money more effectively and achieve your financial goals.

5. Financial Awareness

Using a checkbook register encourages financial awareness and responsibility. By actively recording your transactions, you become more conscious of your spending habits and are less likely to make impulsive purchases. This heightened awareness can lead to improved financial decision-making and increased savings.

How to Use a Free Printable Checkbook Register

Step 1: Download or Create a Template

Start by downloading a free printable checkbook register template or create your own using a spreadsheet program. Make sure the template includes columns for the date, transaction description, payment or deposit amount, and the running balance.

Step 2: Record Starting Balance

Before entering any transactions, record the starting balance of your bank account. This can be obtained from your most recent bank statement or by checking your account balance online.

Step 3: Record Transactions

As you make deposits, write checks, or use your debit card, record each transaction in the checkbook register. Be sure to include the date, a brief description of the transaction, the amount, and whether it is a deposit or withdrawal. Calculate the running balance by adding or subtracting the transaction amount from the previous balance.

Step 4: Reconcile with Bank Statements

Regularly compare your checkbook register with your bank statements to ensure accuracy. Reconciling your register with the bank statement helps identify any discrepancies or errors, such as forgotten transactions or unauthorized charges.

Step 5: Analyze and Adjust

Periodically analyze your checkbook register to gain insights into your spending patterns and financial habits. Look for areas where you can cut back expenses or redirect funds towards your financial goals. Adjust your budget and spending accordingly to ensure you stay on track.

In Conclusion

A free printable checkbook register is a valuable tool for managing your finances effectively. By offering customization, accessibility, visual tracking, budgeting capabilities, and promoting financial awareness, it can greatly contribute to your financial well-being. Start using a checkbook register today and take control of your financial future.

Boost Your Fun with More Free Printables…

Copyright Notice:

We use images sourced from the internet and respect the copyrights of original owners. If you own any image and want it removed, please reach out to us.